As fraud techniques evolve and digital onboarding becomes the standard, verifying customer identities has become a foundational requirement for both compliance and trust.

Identity proofing plays a critical role in today’s digital economy, helping businesses secure platforms, reduce risk, and create seamless, secure customer journeys.

This guide explores what identity proofing is, why mobile-first strategies are essential, and how Telesign’s Phone ID empowers organizations to validate identities in real time—balancing security, compliance, and user experience.

Table of Contents

What is identity proofing?

Identity proofing is the process of determining whether a user’s claimed identity is real, before access is granted, an account is created, or a transaction is approved. It plays a foundational role in digital identity verification, especially in digital-first sectors where securing user access and preventing fraud are business-critical.

Unlike traditional identity verification, which often involves matching a user to a specific credential (like a document or biometric), identity proofing takes a broader approach. It combines signals like device intelligence, telecom data, and user behavior to assess the credibility of a claimed identity.

This multi-step identity proofing process is central to secure, compliant onboarding, particularly in industries that must meet Know Your Customer (KYC), Anti-Money Laundering (AML), and data privacy requirements. It helps detect synthetic identities and other high-risk activity early, making it a core component of identity fraud prevention strategies.

With cutomers mainly interacting via smartphones, mobile identity proofing enables organizations to use trusted data points such as phone numbers, reducing reliance on documents and supporting risk-based identity verification. Solutions that incorporate methods like silent mobile verification, SMS verification, and phone number identity proofing help balance security with user experience.

By integrating modern identity proofing solutions into digital workflows, organizations can support identity proofing compliance, reduce onboarding friction, and strengthen overall identity management.

Why mobile-based identity proofing matters

With more than 7 billion mobile phone users worldwide, the phone number has become a near-universal digital identifier. As customers increasingly engage with platforms through mobile-first experiences, phone numbers offer a practical and scalable foundation for verifying identity.

Mobile identity proofing leverages this ubiquity to establish trust during onboarding and beyond. It enables platforms to validate customers using phone-based signals that are both widely available and closely tied to individual behavior.

Phone number identity proofing offers three key advantages:

- Broad reach and accessibility: Most users have a mobile number that is actively used and maintained.

- Signal-rich data: Carrier and network-level insights—such as SIM swaps, porting events, and number history—can help flag high-risk activity.

- Lower user burden: Techniques like silent mobile verification and SMS verification allow identity checks to occur with minimal disruption to the user experience.

As fraud threats grow more sophisticated, mobile identity proofing provides an adaptable way to confirm a user’s legitimacy without relying solely on documents or manual reviews. When integrated into digital workflows, it becomes a key component of modern identity proofing solutions.

Understanding the identity proofing process

The identity proofing process involves a series of steps designed to evaluate the legitimacy of a customer’s claimed identity before access is granted or an account is created. This multi-step framework helps organizations reduce fraud, meet compliance obligations, and deliver secure, user-friendly onboarding experiences.

Here’s how a typical identity proofing flow works:

1. Data collection

The process begins when a user provides their phone number or other identifying information. At this stage, identity proofing systems gather metadata—such as line type, carrier, and phone tenure—alongside device and network insights. These attributes help establish an initial profile of the customer’s digital identity and set the stage for more advanced analysis.

Solutions like Telesign’s Phone ID API support this phase by retrieving real-time telecom intelligence that includes line status, phone type, and number history. This provides a baseline for assessing trust and legitimacy while ensuring minimal user input is required.

2. Verification

Next, systems confirm whether the user actually owns or controls the submitted phone number. This is commonly done through SMS verification, voice codes, or silent mobile verification using mobile network signals in the background to confirm device and number alignment without requiring user action.

Telesign’s Silent Verification API, for example, performs this step passively, reducing the chance of drop-off while ensuring the number is active and assigned to the user’s device. For platforms requiring active verification, Telesign’s Verify API supports SMS, voice, and time-sensitive PIN code delivery through a global infrastructure.

3. Risk analysis

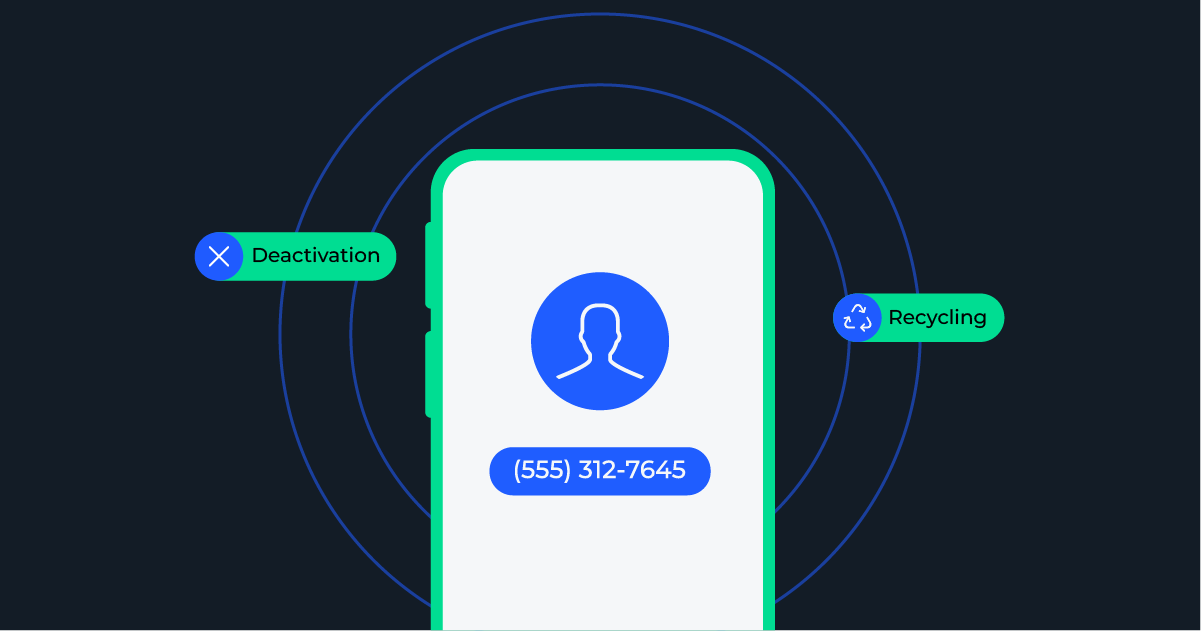

Once verification is complete, the system performs a deeper risk analysis. This includes checking for signs of fraud such as SIM swap activity, recent porting, number recycling, or suspicious usage patterns.

Telesign’s onboarding Intelligence capabilities play a key role here, using machine learning and behavioral analytics to flag anomalies like high-velocity activity, invalid formats, or numbers associated with known bad actors. These insights enable risk-based identity verification and help businesses prioritize resources toward more suspicious profiles.

4. Decisioning

Finally, platforms use aggregated signals to make a decision, approve the user, escalate for manual review, or block the attempt entirely. This decision may be automated or assisted by internal fraud teams, depending on risk thresholds and use case sensitivity.

Well-integrated identity verification APIs allow businesses to route users through different paths based on real-time scoring, helping to streamline onboarding while keeping fraud defenses in place.

Key features of effective identity proofing solutions

An effective identity proofing solution does more than verify a single data point—it evaluates a combination of signals to build trust in a customer’s identity. In today’s threat landscape, this means moving beyond static data and incorporating real-time intelligence that reflects how people actually interact with their devices, networks, and digital environments.

Core features of a modern identity proofing solution include:

- Real-time phone number intelligence: The ability to assess whether a number is active, reachable, and consistent with the user’s behavior and location.

- Carrier and SIM-level insights: Data points like SIM swap detection and recent porting events help identify signs of account takeover or synthetic identity fraud.

- Behavioral and risk recommendations: Evaluating patterns such as usage velocity, format anomalies, and global threat indicators supports risk-based identity verification.

- Number deactivation checks: Identifying whether a number has been recycled helps reduce false positives and prevent fraud during account creation.

- Regulatory readiness: Solutions should support compliance with KYC, AML, and data privacy regulations, providing transparency and auditability as part of identity proofing compliance.

Integration is also key. Leading solutions offer identity verification APIs that are flexible, scalable, and easy to embed into onboarding workflows.These APIs support secure identity verification without compromising the customer experience. For a broader look at how identity verification fits into the customer journey, this guide to customer identity verification offers additional context.

Powering mobile verification with Telesign Phone ID

Telesign’s Phone ID provides a powerful foundation for mobile identity proofing, combining global carrier data with real-time intelligence to help businesses assess the trustworthiness of a phone number—and, by extension, the person behind it.

Built to support fast, secure onboarding at scale, Phone ID delivers key insights that strengthen every stage of the identity proofing process. These include:

- Phone type detection: Determines whether a number is tied to a mobile, landline, VoIP, or invalid source. This helps platforms flag potentially risky accounts.

- Real-time number status: Verifies whether a number is active, reachable, or disconnected, preventing onboarding with invalid or recycled numbers.

- Carrier and porting information: Provides the current and original carrier, along with recent porting activity. These arecritical signals for identifying SIM swaps or account takeovers.

- Number tenure: Assesses how long a number has been associated with a user, offering added context during risk scoring.

- Geographic details: Supplies country-level and region-level data to support location-based decisioning and meet compliance needs.

Phone ID integrates seamlessly into digital workflows via a mobile verification API, making it easy for businesses to apply risk-based identity verification without adding unnecessary steps for customers. It’s built for high availability and supports millions of queries per day, making it ideal for platforms focused on growth, scale, and security.

By turning phone numbers into a rich source of identity context, Telesign helps organizations reduce fraud, improve onboarding outcomes, and support layered identity verification.

How AI is shaping the future of identity proofing

Artificial intelligence (AI) and machine learning (ML) are reshaping how businesses approach the identity proofing process. As fraud becomes more dynamic and complex, static rules alone are no longer enough. AI introduces the speed, adaptability, and scale needed to support detection and response in digital onboarding risk in real time.

Predicting identity fraud patterns

AI excels at identifying behaviors and anomalies that are difficult to spot using traditional methods. By analyzing patterns in phone usage, SIM activity, and network behavior, ML can help detect potential risks like synthetic identities or coordinated fraud attempts before they impact the business.

Threat detection using carrier data

With access to global telecom data, AI systems can monitor signals such as number deactivation, SIM swaps, or porting activity as they happen. This enables platforms to support informed onboarding decisions, strengthening their ability to mitigate fraud at the point of entry.

Continuous learning at scale

Unlike static verification frameworks, AI models evolve. They continuously learn from new data, adapting to emerging fraud tactics while helping maintain a smooth user experience for legitimate customers.

Real-time risk analysis and decision-making

Telesign applies these AI capabilities to build intelligent models that analyze phone number signals in real time. By evaluating dozens of signals, such as number tenure and carrier reputation, Telesign helps businesses perform phone-based identity verification efficiently.

Identity proofing trends and stats

The demand for effective, secure identity verification continues to accelerate as digital ecosystems expand, and fraud risks grow more sophisticated. Several key trends are shaping the future of the identity proofing process:

- Synthetic identity fraud is on the rise. A 38% year-over-year increase marks it as the fastest-growing type of financial crime today. This shift underscores the need for more adaptive, signal-based approaches to identity assessment.

- The digital onboarding market is expanding rapidly. Valued at $1.3 billion in 2024, the global digital onboarding market is projected to grow steadily through 2034, driven by increased demand for remote customer onboarding, mobile-first engagement, and compliance with KYC regulations across sectors such as banking, insurance, and telecom.

- Security and user experience are no longer mutually exclusive. Financial institutions, digital marketplaces, and service platforms face increasing pressure to protect customer data without introducing unnecessary complexity. This has led to a growing preference for adaptive identity verification strategies.

- Passwordless and adaptive authentication models are gaining momentum. The global passwordless authentication market is projected to grow at a compound annual growth rate (CAGR) of 17.3% through 2032, reflecting a shift toward lower-friction, intelligence-driven verification experiences.

These trends point to a global movement toward smarter, more scalable identity proofing solutions—where AI, telecom intelligence, and mobile-first verification support both security and user experience.

Best practices for identity proofing at scale

To build a scalable identity verification strategy:

- Layer verification methods: Combine SMS, phone intelligence, and behavioral scoring.

- Update models frequently: Fraudsters evolve and so must your risk detection.

- Monitor phone number lifecycle: Check for recycling or deactivation to avoid spoofing.

- Reduce friction without compromising trust: Use tools like silent verification to improve conversion.

- Align with regulations: Embed KYC, AML, and privacy by design into your identity workflows.

Why choose Telesign for identity proofing

Telesign helps businesses strengthen their identity proofing process with the scale, intelligence, and reliability required in today’s digital environment. Here’s what sets Telesign apart:

- Global telecom intelligence network: Access to carrier data from across the globe powers accurate, real-time analysis of phone number risk, helping to stop fraud before it starts.

- Privacy-first and regulation-ready approach: Telesign’s solutions are built with compliance in mind, supporting global requirements for KYC, AML, and data protection.

- API scalability for enterprise workloads: Telesign’s infrastructure supports high-volume, low-latency integrations that scale with enterprise demands across industries and geographies.

- Trusted by top global brands: Leading companies in Fintech, e-Commerce, on-demand services, and digital marketplaces rely on Telesign to deliver secure, intelligent identity workflows.

- Seamless integration and onboarding support: Developer-friendly APIs and dedicated technical guidance help businesses go live faster and optimize for long-term performance.

Learn more about Telesign’s digital identity solutions.

Use cases: Identity proofing in action

1. How a Fintech platform strengthened identity verification at sign-up

Company: Affirm

Industry: Fintech

Background: Affirm is a leading U.S.-based BNPL (buy now, pay later) platform that enables customers to split purchases into manageable payments. As it rapidly scaled, the company needed to balance seamless onboarding with robust fraud defenses and without increasing friction for legitimate customers.

The challenge: Affirm was onboarding tens of thousands of customers each day but faced rising fraud risks, including fake identities and number spoofing. The company needed a way to reliably validate phone number ownership and legitimacy as part of its identity proofing strategy.

The solution: Affirm implemented Telesign’s Phone ID and Verify APIs to enhance its mobile identity proofing. These solutions enabled real-time number analysis, ownership confirmation, and fraud risk detection through data such as number type, activity history, and reputation.

The results:

- Increased confidence in customer identity at account creation

- Streamlined onboarding without additional user steps

- Reduced exposure to synthetic identity and phone-based fraud

2. How an e-Commerce platform blocked promo fraud with phone intelligence

Company: Prezzee

Industry: E-commerce

Background: Prezzee is a global digital gift card marketplace offering services to consumers and businesses. With strong growth in new customer acquisition, Prezzee needed to ensure that promotions and incentives weren’t being exploited by fake accounts.

The challenge: Fraudsters were creating multiple accounts with recycled or invalid phone numbers to abuse promo codes and referral programs. Prezzee lacked the tools to verify whether a number belonged to a real customer or had been reused.

The solution: Prezzee integrated Telesign’s Phone ID and Phone Number Intelligence APIs to validate phone numbers during onboarding. These solutions enabled the platform to detect invalid or suspicious numbers, perform number deactivation checks, and apply risk recommendations for phone numbers to flag unusual behavior.

The results:

- Identified and blocked fake accounts in real time

- Protected revenue from fraudulent promo abuse

- Improved the integrity of referral and marketing program

3. How an on-demand mobility app ensured user legitimacy at scale

Company: TIER Mobility

Industry: Mobility / On-demand services

Background: TIER is a leading European provider of shared e-scooters and micromobility services. To maintain trust in its platform, TIER needed a way to verify that each user’s legitimacy without adding onboarding friction in a highly time-sensitive use case.

The challenge: With users signing up quickly before a ride, TIER faced challenges in confirming phone number ownership and blocking high-risk sign-ups without slowing down the experience. Static checks couldn’t keep pace with the scale and immediacy of the platform’s needs.

The solution: TIER implemented Telesign’s Phone Number Intelligence API to power a background mobile identity proofing process. These tools verified number ownership without customer interaction and surfaced risk indicators tied to number history and carrier activity.

The results:

- Verified legitimate users instantly and passively

- Reduced sign-up fraud and abuse

- Maintained a seamless ride-start experience

Building trust through smarter identity proofing

Digital identity has become the first—and most critical—line of defense in today’s online interactions. As fraud tactics evolve and user expectations shift, businesses need to move beyond static verification methods toward adaptive, data-driven approaches to identity.

Identity proofing is no longer just about compliance. It’s also about earning customer trust from the very first interaction. With the right strategy in place, organizations can improve onboarding outcomes, help reduce risk exposure, and deliver seamless, secure digital experiences at scale.

By combining phone number insights, AI-powered risk analysis, and global reach, Telesign enables modern businesses to implement effective, scalable identity proofing solutions that align with both security and customer experience goals.

Explore how Telesign solutions enable digital identity verification for onboarding, compliance, and fraud protection—talk to our experts today.

Frequently asked questions

Identity proofing is the process of determining whether a user’s claimed identity is legitimate. It involves collecting data, verifying identity signals (like phone number ownership), analyzing risk factors, and making a trust decision before granting access or completing onboarding.

Identity verification typically refers to confirming a specific credential—like a document or biometric. Identity proofing is broader, combining multiple signals (e.g., telecom metadata, device behavior, risk recommendations) to assess whether an identity is real and trustworthy.

Yes. Mobile identity proofing uses real-time phone data—such as number type, SIM history, and tenure—to detect high-risk patterns and thwart fraud, including synthetic identities, fake accounts, and SIM swap attacks.

Phone intelligence and telecom-based signals can support KYC identity proofing and Anti-AML efforts by providing additional verification signals.

AI helps predict fraud by analyzing large datasets and behavioral patterns. It continuously learns from new signals, allowing businesses to adapt to emerging threats while improving accuracy and reducing false positives.

Yes. Tools like number deactivation checks and carrier intelligence can identify whether a phone number is inactive, recently reassigned, or linked to fraudulent activity—key indicators in preventing onboarding abuse.