Financial Services and Fintech

Beyond digital identification: Protecting your users, brand, and platform from fraud

In this eBook we’ll cover:

- The costly impact of fraud for the financial services industry.

- Where fraudsters take advantage and how digital identity verification can fill the gaps.

- How mobile phone number insights can be leveraged for enhanced digital identity verification at key touchpoints.

Build a secure, compliant digital experience

Onboard with mobile identity data to save your eKYC program time and money. Detect suspicious activity before potential fraudsters go deep into your identity verification workflow.

Flag fraud early

Enhance onboarding security with carrier subscriber data to detect fraudulent account creation quickly.

Streamline sign-ups

Make it easy for customers to get started with less friction for improved completion rates.

Cut eKYC costs

Identify fake accounts before undertaking more expensive biometric, document, and other identity verification measures.

Safeguard reputation

Maintain your trusted reputation online with proactive security measures that keep accounts safe and your ecosystem protected.

Keep customer accounts and investments safe

Detect suspicious behavior like SIM swaps, porting history, and call forwarding to protect customer accounts and verify identity with flexible possession checks.

Verify behind the scenes

Avoid fraud involving one-time-passcodes (OTP) by authenticating customers with mobile subscriber data and no user interaction.

Confirm account changes

Require verification before allowing account updates to prevent fraud with end-to-end account security.

Challenge risky behavior

Verify account information with flexible possession checks when unusual account activity occurs.

Future-proof verification

Authenticate customers across SMS, Silent Verification, Push, Email, WhatsApp, Viber, and RCS with automatic fallbacks.

Stop social engineering

Keep your customers and brand safe from social engineering fraud and stop unauthorized access with customer identity data and dynamic risk signals.

Customize engagement with customers

Prioritize security and accuracy in customer communications. Send verification codes, transaction confirmations, account notifications, and business updates on your customers’ preferred channels.

Ensure data accuracy

Keep up your contact databases with phone number contact, number type, activation status, and more to increase deliverability.

Message securely

Send personalized bill reminders, balance alerts, and other confidential notifications to verified customer contact data.

Personalize your options

Send messages to customers where they prefer to communicate across SMS, RCS, MMS, WhatsApp, Viber, and email.

Scale easily

Maximize your messaging strategy options with a developer-friendly API that enables market and channel expansion.

45%

of consumers

do not actively protect themselves against cybercrime.

30%

of consumers reported that they were victims of fraud

in the last three years.

61%

of victims reported financial losses.

94%

of consumers agree that businesses bear the

responsibility for protecting their digital privacy.

46%

of digital fraud victims are between the ages of 25-44.

Product recommendation

Intelligence

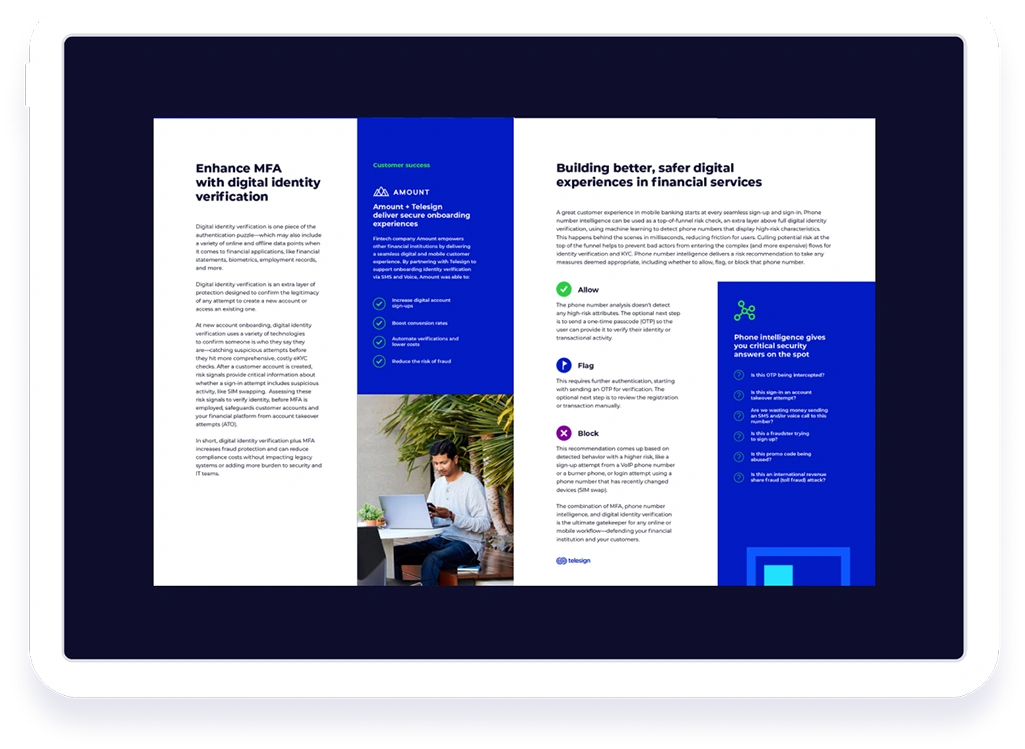

Risk-based decision-making

Integrate risk analysis into onboarding and fraud prevention workflows to quickly and accurately flag fake accounts and suspicious activity with tailored scoring models and comprehensive reason codes.

➔Phone ID

Account identity assurance

Access comprehensive and global mobile identity data sets to quickly and accurately verify phone numbers and other account information for a protected customer experience.

➔Verify API

Flexible account authentication

Build verification into every sign-up, sign in, and transaction that poses a risk for your customers or brand. Protect account access with one API that enables seven different verification channel options.

➔Messaging API

Personalized engagement

Keep your customers informed with secure, personalized messages delivered to their preferred channels with a flexible, interactive, and global engagement experience.

➔Other resources

Clients who use this product

Telesign provides Continuous Trust™ to leading global enterprises by

Connecting

Protecting

Defending

their digital identities

Talk to sales