Recently, there has been a barrage of news and reports surrounding large companies and their problems dealing with fake users plaguing their platforms. From Twitter to dating apps, this problem won’t seem to go away.

And now the fintech world is in the spotlight (and likely wishing they weren’t). According to PayPal CFO John Rainey, more than 4.5 million PayPal accounts have been flagged as fake.

This news rattled PayPal, the fintech industry, and consumers and businesses that rely on apps like PayPal to make and receive payments.

Fortunately, there is a solution to the problem.

What happened and what was the fintech industry’s reaction?

This excessive amount of fake accounts was revealed during a recent PayPal evaluation of its user base. One of the biggest problems resulting from these millions of fake accounts was promotion abuse. PayPal had offered up to $10 of free deposits whenever a new account was created. It doesn’t take a math whiz to realize that 4.5 million fake accounts exploiting this promotion would be extremely costly.

And as it turned out, it would change the way PayPal operates. PayPal’s solution was to disengage entirely with all types of incentive programs stopping their $5-10 dollar sign-up bonus which will help stop the fraud, but what about the millions of legitimate users who now miss out on rewards? There could be more creative ways to handle the issue.

Incidents like these force us to assess what types of dangers exist and how we can respond to them. Let’s look at fake accounts, how they are created, and why they are dangerous.

Fake accounts

Fake accounts are created by illegitimate users to inflate ‘like’ clicks, commit fraud, or manipulate installation data. Fake users take stolen or made-up email addresses, phone numbers, or usernames to create profiles that can sneak through security checks.

Once a fake account is onboarded, it can harm an ecosystem in various ways, including networking with unsuspecting valid users, impersonating brands, committing fraud, and spreading false information.

One of the most devastating impacts caused by fake accounts is promotion abuse.

Promo abuse

Promo abuse is when users create multiple accounts or fake accounts, often used only once, to take advantage of coupons, free trials, referral rewards, and other promotions.

Because of how minimal things like referral rewards and signup bonuses often are, it’s easy to underestimate promo abuse. However, if left unaddressed, promotion abuse can be extremely costly, leading to large revenue losses and high customer acquisition costs.

How should fintech companies react to these fake accounts?

The best approach is systematic, keeps things simple for valid users to onboard, and has several methods to increase the security of a platform. Due to the way fake users sneak in, the first step should be a verification process for any new user. After that, eradicating fake accounts from the system by actively monitoring fraud indicators is a good way to prevent further damage.

Here are some key ways to reduce fake accounts:

- Verify user identities using modern tech

- Require MFA to protect valid users

- Actively monitor user accounts and behaviors

After that, you’ll want security tools that are designed to effectively prevent these fake account problems, which is where Telesign shines.

How Telesign can help

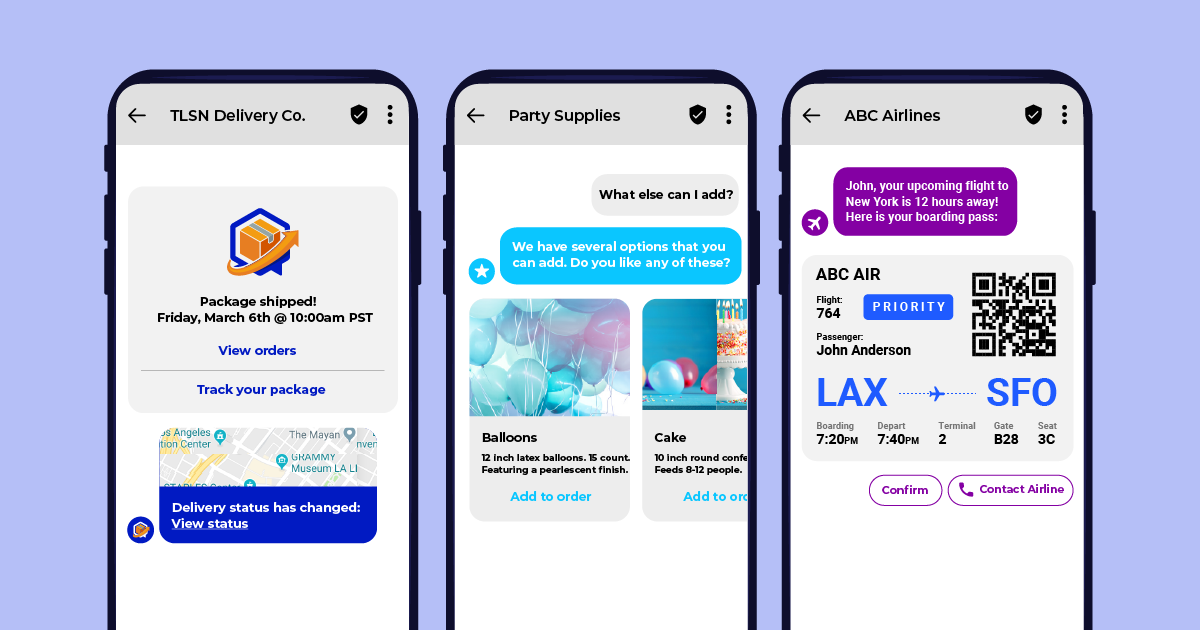

The best tools to shut down fake accounts, and subsequently promo abuse, for fintech are those that effectively assess new user risk. This is done primarily in the onboarding process.

Telesign draws on over fifteen years of historical data patterns and consumer insights, instantly assesses the risk, verifies the identity, and authenticates every new user that enters your ecosystem. Telesign analyzes phone, email, and IP behaviors and identity signals to detect fake accounts and fraudulent risksÑall while fast tracking your legitimate customers.

This ensures new accounts are legitimate and not simply created to take advantage of free trials, thereby boosting referrals and true growth metrics.

Telesign provides an effective risk assessment of different identity factors, as they are not equal in weight. For example, it is easy to obtain a new email, so a new user who provides one does not offer much in terms of security and trust.

A phone number is much more trustworthy, and Telesign uses global data to determine how valid and trustworthy a particular number is. This is just touching the tip of the iceberg when it comes to the comprehensive coverage of Telesign’s risk assessment.

To stop fake accounts, Telesign Intelligence is your best bet, offering a modern approach to assessing new user risks.

Final thoughts

PayPal isn’t the only fintech company that suffers from fake users, but due to its success and longevity in the industry, it serves as a powerful example for others that these problems are a reality.

However, if you are in the fintech industry, it’s not time to panic. Eliminating valid programs such as promotions is a quick solution that does not solve the problem. Instead, look to digital identity solutions to stop fake accounts before they plague your system.

To learn more about how Telesign is the key to keeping fake accounts off your fintech company’s platform, chat with us today.