As Winston Churchill once wisely said, “With great power, comes great responsibility.” Digital identity can create unlimited power at your fingertips, allowing you to easily navigate the online world and access anything from banking and healthcare to social media and shopping. However, this level of convenience comes with the need for safe online practices, as managing your digital identity responsibly is crucial to protecting your personal information.

Digital identity plays a critical role in verifying user identities, safeguarding security, fostering customer trust, and ultimately, reducing fraud. It’s also a powerful tool for enhancing engagement and driving long-term customer relationships. In the absence of physical documentation, digital identity attaches unique data that accurately confirms your identity online.

Digital identity identifiers can include:

- Phone numbers: Personal phone numbers tied to a user’s mobile device.

- Biometrics: Fingerprints, retinal scans, or facial recognition.

- Birthdates: A key data point that helps verify identity when paired with other information, like a phone number.

- Usernames/passwords: Credentials used for email accounts, online banking, gaming, and social media platforms.

- Government-issued identifiers: Social security numbers, driver’s licenses, and passport numbers.

- IP addresses: Geolocation data tied to the user’s device.

- Purchase history: Tracked spending patterns and payment methods used across various online platforms.

These identifiers not only strengthen identity verification but also enhance customer engagement. By capturing customer data through transactions and interactions, businesses can enhance their strategies and deliver personalized experiences. Engaged customers generate valuable insights, helping companies shape their outreach efforts and foster brand loyalty. Beyond strengthening identity verification, digital identifiers also offer a range of benefits that improve both the customer experience and business operations, driving deeper engagement and long-term success, such as:

- Enhanced security: Digital identifiers help verify the identity of users, reducing the risk of fraud and unauthorized access.

- Streamlined user experience: By allowing users to sign up using existing digital identities (like social media accounts or email), the process becomes faster and more convenient.

- Reduced abandonment rates: A simplified sign-up process can decrease drop-off rates, leading to higher conversion rates.

- Regulatory compliance: Using recognized digital identifiers can help businesses comply with data protection regulations by ensuring user consent and secure data handling.

Table of Contents

The dark side of digital identity

While digital identity offers many benefits, it also has a darker side. Identity theft is a significant risk, as fraudulent actors seek to exploit personal data for financial gain. The dark web serves as a marketplace where fraudsters prey upon weaknesses in online security to buy and sell stolen identities. Common tactics used in these attacks involve SIM swapping, call forwarding, and porting, where bad actors gain enough knowledge about the victim to convince telecom providers to make these changes. Once in control, they intercept one-time passwords (OTPs), allowing them to take over accounts and initiate a string of fraudulent attacks.

Account takeovers (ATOs) occur when fraudsters exploit vulnerabilities like stolen credentials, poor security practices, or weak onboarding. Poor internet habits, such as oversharing on social media or using weak, reused passwords, make it easier for attackers to compromise multiple accounts through initial fraudulent activities like phishing, breaching data, credential stuffing, and more. What’s more concerning is that over half of all internet users still rely on weak or reused passwords, despite the known risks. The consequences can lead to significant financial loss and a negative impact on brand reputation. To mitigate these risks, businesses should leverage multifactor authentication (MFA), strengthen onboarding processes with preventative fraud tools, and educate users on security best practices.

Emerging digital identity trends for 2025

In 2025, the focus on protecting digital identities from fraud will intensify as online services and transactions continue to grow, bringing with them more sophisticated fraud risks.

Phone numbers for identity verification: Phone numbers will continue to play a crucial role in enhancing security, serving as a trusted form of identity verification and in multifactor authentication (MFA). Currently, phone numbers are essential for account recovery, enabling users to regain access when passwords are lost. By tying user accounts to phone numbers, businesses can better protect against fraud, quickly verifying users and flagging suspicious activities based on phone number attributes like device type or location data. Furthermore, phone numbers will help combat synthetic identity fraud, as they can be difficult to fake and can also be verified in real time.

Stronger data regulations: As the digital world rapidly evolves, so do the challenges and innovations. Stronger data regulations are being introduced to protect consumers from fraud. According to Socure, since June 2022, U.S. senators and regulators, including the Consumer Financial Protection Bureau (CFPB), have advocated to shift the burden of payment scam losses from consumers to the banks and fintechs that hold the receiving depository accounts in these transactions. This proposed liability change would likely apply to all payment methods, such as ACH, wire transfers, checks, ATM crypto transfers, and P2P payments. This puts pressure on banks and financial institutions to ensure their users’ information remains uncompromised.

Digital driver’s license: Another emerging digital identity trend for the upcoming year is digital driver’s licenses. Digital drivers’ licenses are set to revolutionize how we carry and present our identification in an increasingly digital world. According to the LA times, this new way to carry your driver’s license is currently being tested in California and has already attracted over half a million users. This digital ID can be set up through the DMV Wallet found on Google and Apple stores. Digitized driver’s licenses will reshape the digital identity landscape by providing a safe and secure way to access your ID on mobile devices. They enhance privacy by allowing users to share only necessary information for certain transactions, which can help prevent identity theft. With features like biometric authentication, these licenses will simplify identity verification. As more states implement digital IDs, we may start to see a trend towards a standardized approach to managing digital identity, increasing trust in online interactions.

For businesses, digital identity is a powerful tool for deepening customer engagement and driving loyalty. However, it’s essential to stay ahead of the risks that accompany it. As trends like digital driver’s licenses and stricter data regulations emerge, the digital identity landscape will continue to evolve, reshaping the ways we connect, protect, and defend our information in the online world.

How Telesign helps: Telesign Phone ID

In today’s digital landscape, ensuring the security of your digital identity while enhancing customer engagement is critical. For businesses, this means integrating best-in-class solutions that protect user data, build trust, and create personalized experiences.

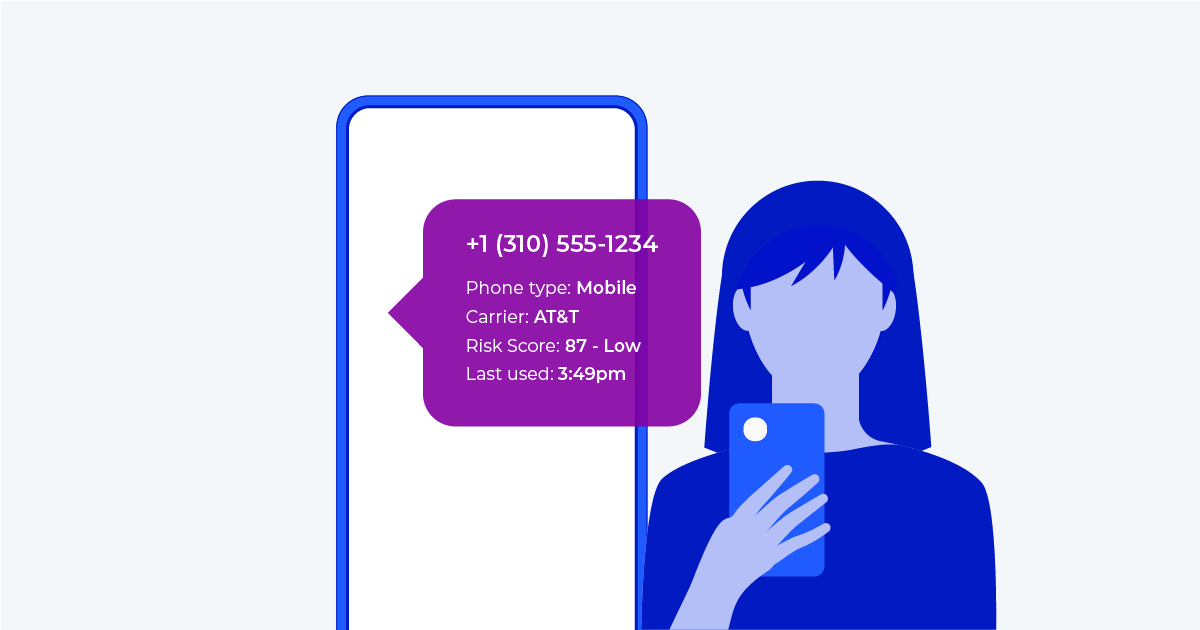

Telesign offers a comprehensive suite of digital identity solutions designed to protect digital identities and provide seamless customer interactions. With Telesign’s Phone ID, businesses can understand the strength, value, or risk of an interaction through the use of phone number attributes, including contact information, location, and so much more. It validates the user verification process, eliminates timely and costly knowledge-based authentication methods, reduces fake accounts, improves conversions, and even determines the optimal channel of message delivery.

A key feature of Phone ID is the Breached Data API, which alerts businesses when user data has been compromised and protect their users and ecosystem. It also helps combat synthetic identity fraud by striking a balance between strengthened authentication and a seamless customer experience. The API notifies businesses during the sign-up process if a user attempts to register with recently breached personally identifiable information (PII).

Telesign’s Phone ID is essential for preventing SIM swap attacks by identifying when a phone number has been deactivated, recently ported, or has call forwarding enabled. It also enhances know your customer (KYC) and onboarding processes with Phone ID Standard, an add-on that delivers detailed, actionable insights into phone numbers and subscriber data. These insights help businesses detect fraud more accurately, choose the best communication channels, and clean up invalid numbers. Phone ID can also include includes Contact, Contact Match, and Email ID add-ons, which provide extensive information such as the name, address, and email linked to a phone number, offering deeper verification and protection against fraud.

Protecting digital identities while fostering seamless customer engagement is essential in today’s digital landscape. Telesign’s Phone ID is a powerful tool that provides businesses with enhanced security, fraud protection, and valuable insights into customer data. By integrating these comprehensive solutions, businesses can safeguard user identities, streamline onboarding, and deliver more personalized experiences—ultimately building trust and driving long-term customer loyalty. Learn more about Phone ID here.