Digitization of the payments industry has given rise to many new forms of payment, a popular one being the “buy now, pay later” (BNPL) industry. BNPL is offered through a segment of FinTechs, opening up a world for new payment possibilities for consumers and businesses alike.

The BNPL industry is worth billions and offers new flexibility to consumers. The option to spread payments over time makes this method highly appealing for those with tighter budgets. By providing customers with the BNPL services/options, retailers gain access to a larger pool of buyers and an increased demand for higher-priced products.

As attractive as this may sound, BNPL comes with inherent risks that both businesses and consumers should consider. Fortunately, there are ways for firms to mitigate these.

Table of Contents

What is buy now pay later?

Buy now, pay later is a financing option that lets consumers make purchases immediately but hold off on payment for a future date. BNPL is segmented so that a consumer can repay money in smaller amounts over longer periods of time.

The online shopping experience has changed vastly over the last few years—the introduction of BNPL payments being a large part of these changes as a new payment method, regardless of good credit. In online shopping, BNPL is a payment method that typically appears in the checkout stage of the transaction or as a note alongside the item’s price. It gives shoppers the option to purchase an item in multiple installments. For many consumers, the BNPL benefit is compelling when looking to buy goods or services outside their average price range.

Generally, using BNPL alternatives only requires a payment of approximately 25% of the total item upfront. The remaining balance is paid off in equal installments over the next few months with no fees or interest charges.

This type of immediate, no-cost financing has become increasingly popular throughout the COVID-19 pandemic. While some use it to buy smaller necessities and everyday living expenses, others are excited to buy big-ticket items without paying the total amount upfront.

Also considered a type of short-term loan, these payment options are popular among consumers who don’t qualify for a credit card or prefer an alternative financing option that allows them to spread out payments.

The risks of offering BNPL

Products with an option for BNPL involve borrowing money. While the process of borrowing and loaning money happens every day—from applying for mortgages to securing a credit card—BNPL transactions typically include buying everyday items like espresso machines or new clothes. However, BNPL transactions that fail to result in a positive outcome can result in accumulated, unaffordable debt for society’s most vulnerable and lost profits for businesses.

The BNPL services are similar to common forms of payment such as personal loans or zero-interest credit cards but are much more accessible. So much so that many people have started treating them as an alternative to their everyday credit card. However, while those customers may originally intend to make timely payments, unplanned situations arise that prevent them from taking advantage of BNPL perks. This was the case for many during the economic crisis of the Covid-19 pandemic.

Inability to make payments on BNPL purchases leads to bad loans and other negatively associated impacts. The critical problem is how accessible the BNPL option is. With the button typically located among the payment methods on checkout pages, most users are unaware that BNPL holds the same implications as taking out a loan.

Quick lending decisions and regulatory issues

Experts predict that the BNPL industry could quickly become problematic if left unregulated. BNPL regulations are in the early stages, including newly proposed UK regulations to protect consumers by creating a blueprint to mitigating bad loans in other countries and markets.

Approving BNPL purchases from customers who don’t fully understand the implications of the purchase is a big problem for businesses. Companies offering BNPL need to quickly and accurately gauge the ability or intent to pay. While regulations are still on the horizon, mitigating risk and protecting consumers from bad debt is already something the BNPL industry is tackling. The challenge is making fast lending decisions to first-time buyers without credit history. How can businesses try to solve this issue? By tapping into digital identity intelligence.

The benefits that come with offering buy now pay later

It stands to reason that convenience is a big part of why your customers will be grateful for BNPL, but the benefits it offers to you as a company are more extensive. Here are some of the more important benefits it could bring:

- Reach wider customer demographics. Like any other type of sales or service offering, different demographics of customers flock to particular choices. Younger customers have been shown to prefer having BNPL as an option, making it vital, especially if your service or product is aimed towards a younger crowd.

- Increase sales transaction volume and quality. Offering BNPL alone may attract more customers, but it also could encourage them to select a more expensive product or service package as well. Studies indicate that customers spend more when BNPL is offered, and about 38% believe BNPL services will replace their credit cards.

Now that you’re aware of why it’s so important to offer BNPL, let’s look at the best ways to do so.

The best way to offer BNPL: Digital identity and security solutions

Digital identity solutions help BNPL providers improve their knowledge of customers in transactions where the cardholder is not physically present. This is highly prevalent to online retailers that sell merchandise through their e-commerce store.

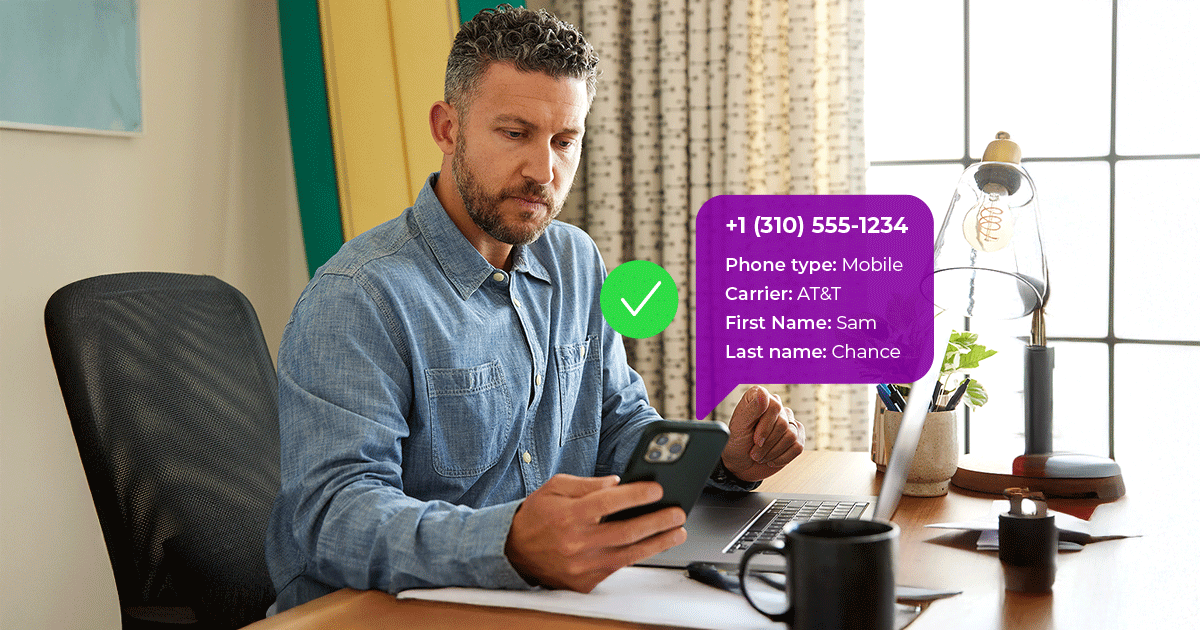

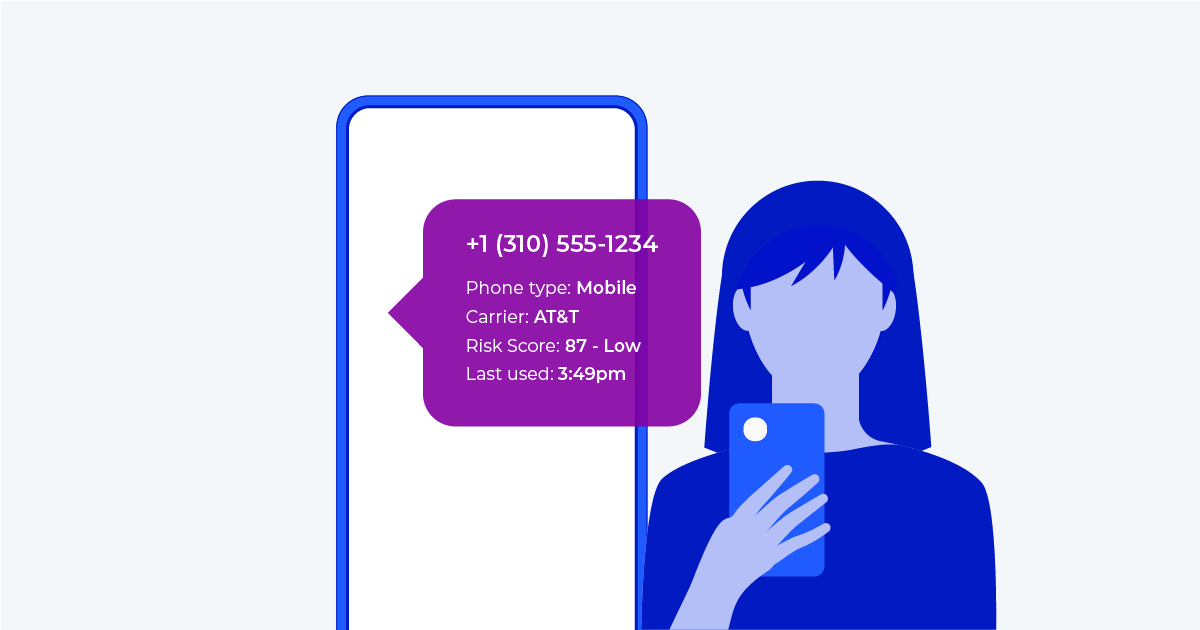

Using data signals tied to a customer’s online presence, like phone numbers, email addresses, or device IDs, allows a company to make accurate lending risk assessments. Phone numbers are a uniquely powerful source of digital identity, as they bridge the physical world with the online world by creating an authoritative connection to help organizations better identify customers.

Any business considering implementing BNPL payment options should consider using a digital identity solution to:

- Ensure contact details obtained are correct so your business can reach customers and offer better support, especially when there are financial red flags.

- Contend with more nuanced purchase situations. For example, a teenager who uses their parents’ records to purchase but provides their own phone number to verify the one-time password.

- Cross-verify contact details on an application with machine learning data technology that finds inherent data behind a customer’s phone number to better understand BNPL applicants.

How Telesign makes BNPL more secure for retailers

Telesign’s digital identity solutions deliver risk intelligence from a global network of hundreds of thousands of unique consumer insights and data points to help organizations protect their customers and themselves while maintaining privacy, trust, and growth.

Telesign helps BNPL providers stay secure by:

- Providing profile coverage of buyers who may be first-time buyers or do not have any credit records.

- Validating consumer phone numbers and ensuring the phone number is associated with the same person attempting to complete the transaction.

- Running an automated phone number-based risk analysis across more than 9 billion global phone numbers.

- Verifying details provided by new users versus the mobile operator consumer data.

- Validating these users by gathering further information based on phone status, account history, and digital activity history.

- Cross-verifying provided contact details in an application with phone number ownership data.

- Validating provided information and quality of the phone number itself.

- Checking the reputation of the phone number for suspicious activity or origins.

- Preventing “intent of non-payment” and fraud by gauging the risk of each incoming loan request.

If you’re interested in learning more about how we help companies who offer BNPL protect themselves, check out our case study ‘How Telesign completes the Affirm tech stack‘.